In The Moment

Can You Improve Your Emotional Intelligence?

Date: April 18, 2024

5 Tips to Master Your Problem-solving Skills

Date: April 15, 2024

How to Improve English Speaking Skills?

Date: April 8, 2024

In Pursuit of Excellence

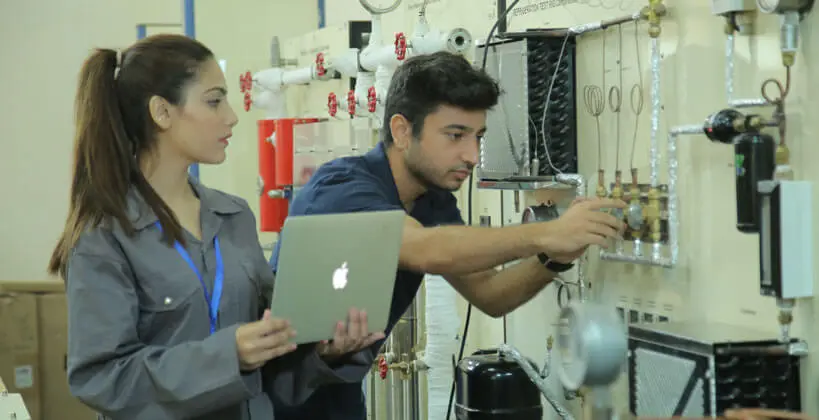

World class facilities

Foreign qualified faculty

Our Community